Plenty of CEOs are feeling at the top of the world this earnings season. One can expect the bar bills at Kokkari and Nobu to skyrocket as they celebrate. Of the 90% of listed companies that have reported results for the quarter, over 80% have beaten consensus earnings estimates. Most US indices, led by this positive momentum, soared to new all-time highs.

So why is sentiment so wobbly? Despite all the good news, the folks paid to analyze these companies are not exactly popping the champagne. A Citigroup index that tracks whether analysts are upgrading or downgrading their earnings estimates is barely in positive territory, sitting at just 0.15.

This index is considered a leading indicator for shifts in corporate earnings. Its weakness indicates analysts don't think that the good news will last, or that its broad enough to translate into meaningfully higher profitsin the near future. The vibes are not great.

Take AMD, for instance. Its Q3 numbers came in ahead of estimates, and its Q4 outlook also beat the consensus. But the stock still tanked by over 3% on results day and has been trending downward since. It’s the same story for Palantir, Uber, and a long list of other tech darlings.

As Bloomberg analysts point out, the problem wasn't that the outlook was bad per se—it's that it wasn't spectacularly, unbelievably good. The outlook didn't clear the “most optimistic of estimates.”

This is the classic sign of a stock “priced to perfection.” The market has already baked in every possible piece of good news, and believed everything promised by top management. Now anything less than a miracle is a disappointment. This is the theme for just about every AI flagbearer.

As an investor, you must be thinking about what you should do at this moment. Michael Burry says,

“Sometimes, the only winning move is not to play.”

Interestingly, the photo Burry posted with this quote was not of himself, but of movie star Christian Bale, who played him in the film The Big Short. Has Burry bought into his own mythology, and is unwisely betting against market wisdom with his AI short? Or is the bubble really ready to burst?

The problem with pessimism

The investor and cofounder of Merrill Lynch, Charles Merrill, was worried about over-valuation and speculation in the 1929 stock market. He pulled all his funds out early that year, and warned other investors. But the stock market continued to rise by another 90% before it finally collapsed. The problem with being the pessimist in the room, is that people can hold on to their beliefs much longer than you think, against all evidence.

This time around, many investors are echoing Burry's warnings. Berkshire Hathaway's cash pile is rising every quarter. It now stands at a staggering $380 billion. When one of the world's most successful investors is hoarding cash instead of buying stocks, it pays to ask why.

Bubble, bubble, toil and trouble: the hype train has led to sky-high valuations

Why is everything so expensive if the smart money is on the sidelines? In a word: AI.

The argument that drove the spike in AI valuations, is that AI will contribute up to $15.7 trillion to global GDP by 2030, where $6.6 trillion would be from productivity gains and $9.1 trillion from increased consumption.

AI company CEOs like Sam Altman also talked up the prospect of Artificial General Intelligence coming at the end of the year (a promise that got advanced by another year at the start of every new year).

This optimism lit a fire under AI-tracking ETFs (like the Global X Artificial Intelligence Technology ETF and the iShares Future AI & Tech ETF), which are trading at an annual gain of around 30%. This frenzy has pushed the whole market into nosebleed territory with the S&P 500 trading at a P/E of 28, while the Nasdaq 100 index trades at a P/E of 37. Both indices are at record highs after surging more than 14% this year.

Not everyone is sounding the alarm. Robert Edwards, chief investment officer at Edwards Asset Management, said that he thinks big tech stocks still have “gas left in the tank.” But even he added, somewhat weakly, that it is “time for a rotation into other parts of the market.”

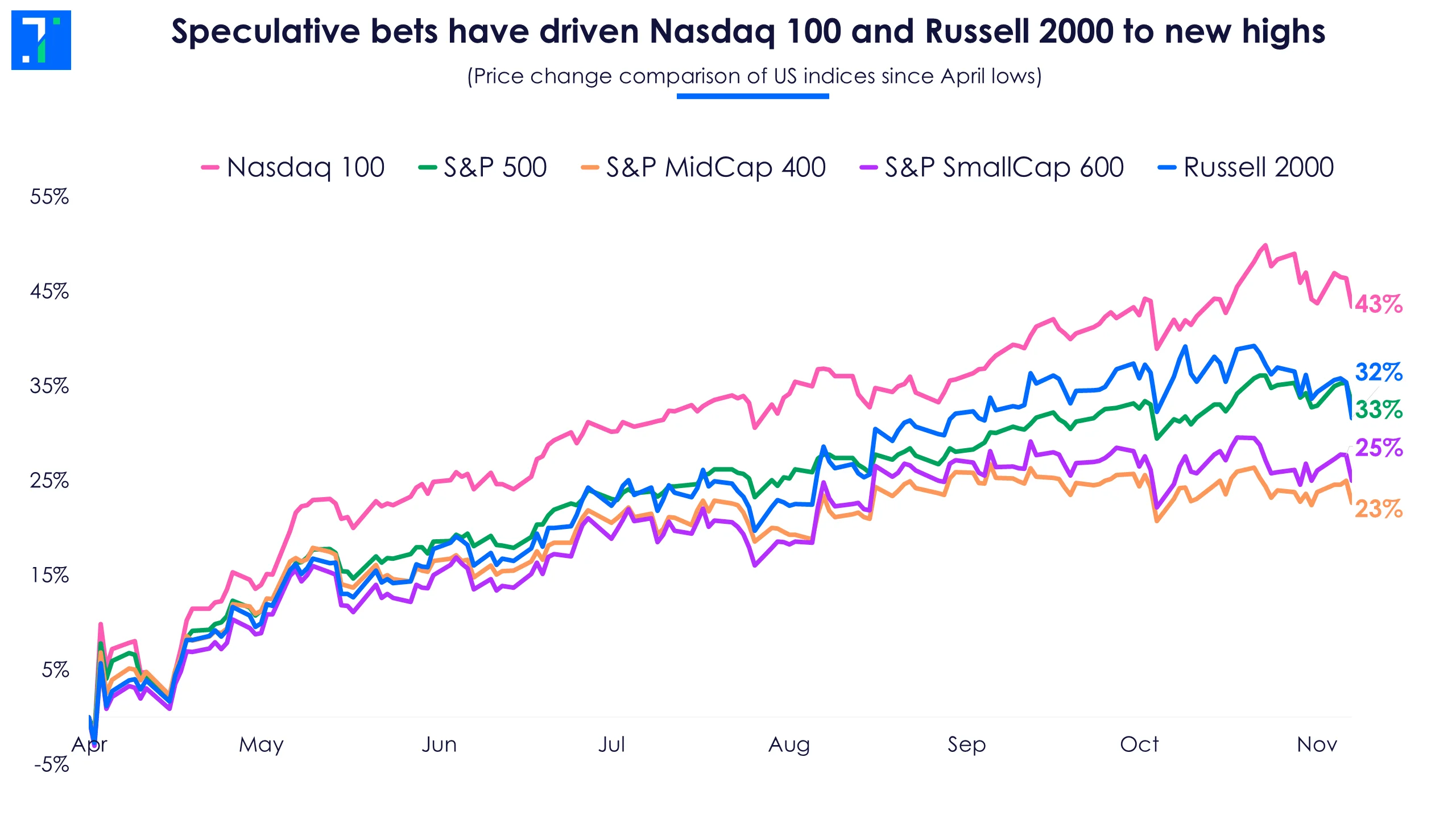

Interestingly, the Russell 2000 (a small-cap index) has gained nearly as much as the S&P 500 from its April lows. Analysts attribute this to speculative and momentum bets, as more than 40% of the small-cap index's constituents are loss-making firms. Meanwhile, the S&P Midcap 400 is trading at a gain of 3% year-to-date.

Value is getting harder to find

Legendary investor Howard Marks of Oaktree Capital notes that every time the S&P 500 has traded at a forward P/E above 23 (think the dot-com peak or the 2021 highs), the next decade for investors has been miserable. We're talking average annualized returns of just 2-3%.

The reason is that when valuations are this high, there's no room for them to go higher. You are completely dependent on earnings growth that, historically, almost never lives up to the hype.

It’s a stark reminder that investing at the right valuation is just as important—and maybe more important—than investing in a good company.

So, where is the value now? It's pretty scarce.

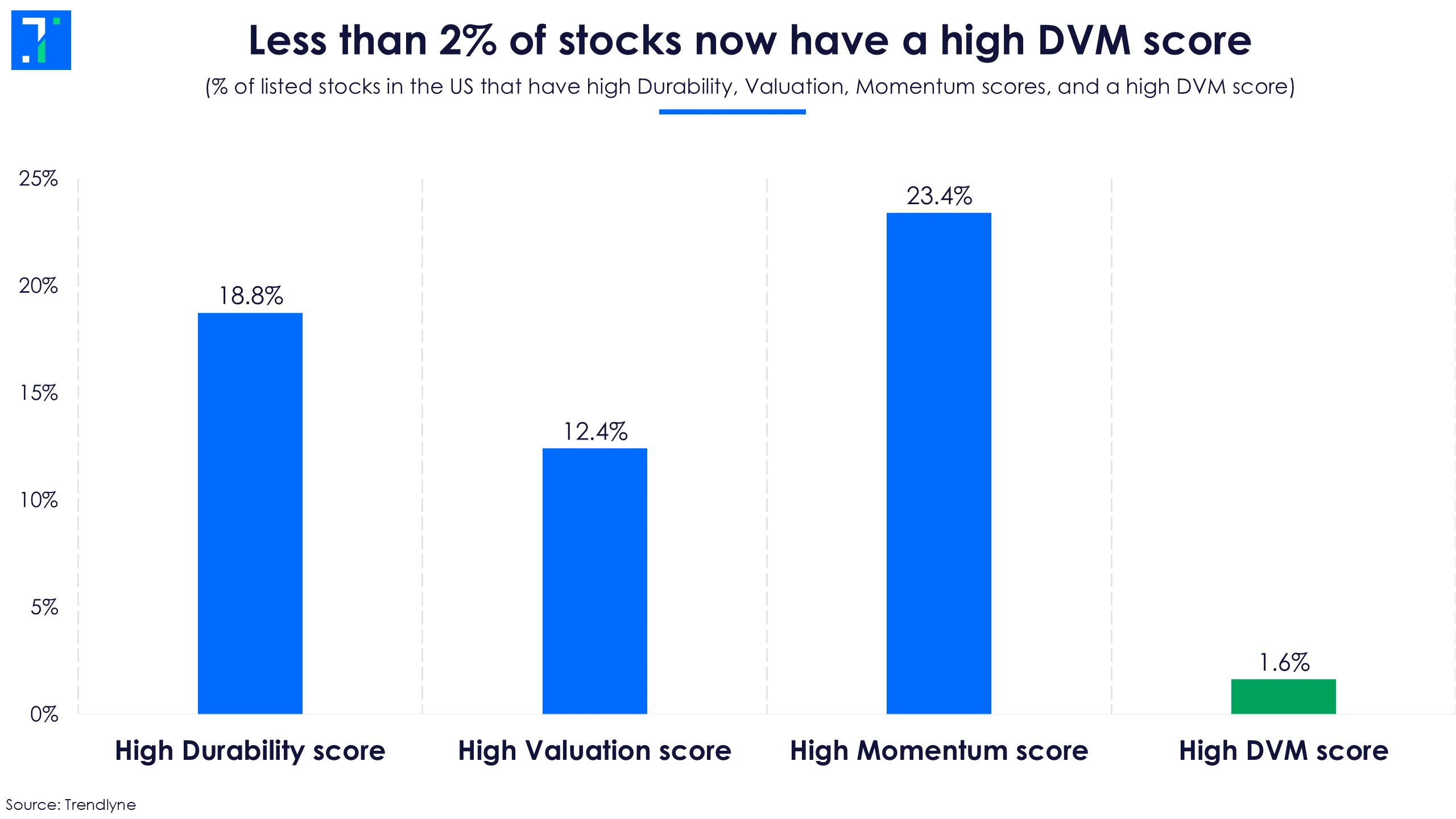

Trendlyne’s valuation score checks if a stock is competitively priced based on its P/E, P/BV, and share price, among other metrics. A score over 50 is a good initial filter for value.

Right now, less than 12% of all listed stocks in the US market have a valuation score above 50.

Check out this screener to filter all the value stocks based on Trendlyne’s valuation score. You can also edit the query to make the criteria more stringent or more relaxed, as you like.

Finding the unicorns

That 12% figure—that only about one-tenth of the market is “at value”—tells you just how overstretched things are. The other problem is that a “cheap” stock in this market isn't necessarily a “good” stock. A lot of stocks are cheap for a reason!

To find real opportunities, you need to find the (rare) combination of all three:

- Durability: A solid business with stable revenues, profits, low debt, and good cash flow. (Right now, over 900 stocks have a Durability score above 55).

- Momentum: The stock is actually in an uptrend and showing buyer demand. (Over 1,110 stocks have a Momentum score above 60).

- Valuation: It's not crazy expensive.

How many stocks in the entire market have all three? Trendlyne’s Strong Performers screener filters for exactly this: high durability, good valuation, and strong momentum.

The result? Less than 90 stocks.

That’s it. Less than 2% of all US stocks. That's how rare it is to find a high-quality, fairly-priced company these days, that also has the wind at its back. A few of the names that currently make the cut include Leidos Holdings, Western Digital, Great Lakes Dredge & Dock Corp., Enersys, and Invesco.

Do check out the screener at Trendlyne to make more such filters of your own.