Wall Street is breathing easier.

Even as the market rally cools, this earnings season is delivering some happy surprises, with 85% of S&P 500 companies beating profit estimates -- the best showing in over four years.

The results suggest that corporate earnings have held up despite a shaky world economy, tariffs and inflation.

The good news isn’t confined to Big Tech.

-

Finance giants aced their results, as Citigroup and Morgan Stanley both beat revenue estimates by 4.3% and 9.3%.

-

The industrial sector also got a lift. General Motors raised its profit guidance by 11%, fueled by robust truck sales and tariff relief.

-

Even consumer spending has held up. Coca-Cola outperformed, showing that consumers are still spending despite higher prices.

JPMorgan Chase analysts summed it up:

“US companies should continue to deliver superior earnings growth supported by a robust AI cycle, ongoing deficit spending, and a resilient consumer.”

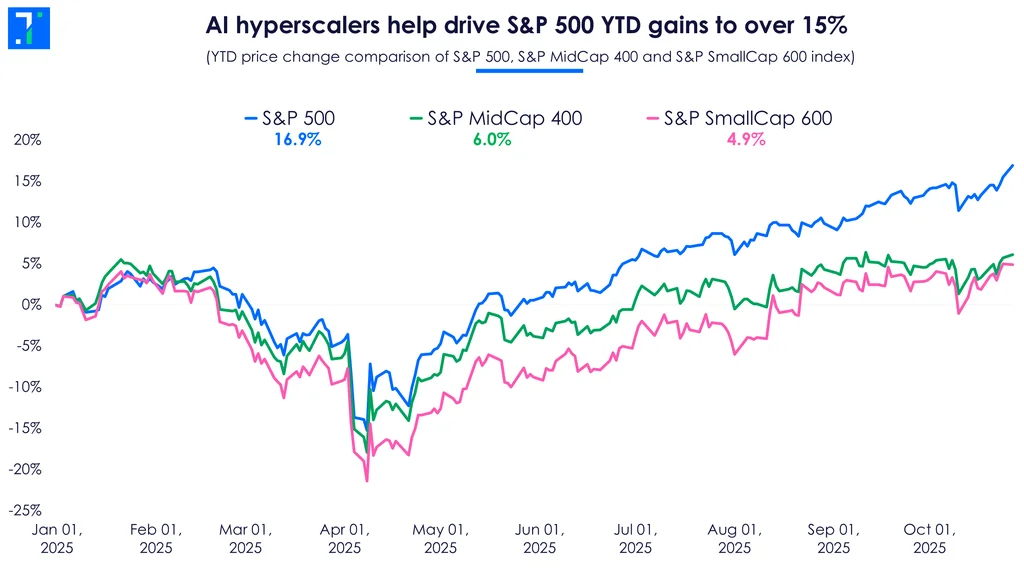

AI momentum pushes S&P 500 to record highs

No surprise here: AI remains the market’s heartbeat.

Goldman Sachs expects this rally to broaden further beyond Big Tech, and to midcaps and smallcaps, thanks to earnings strength and upcoming interest rate cuts. We look at three promising players in large, mid and smallcaps.

AI hyperscalers help drive S&P 500 YTD gains to over 15%

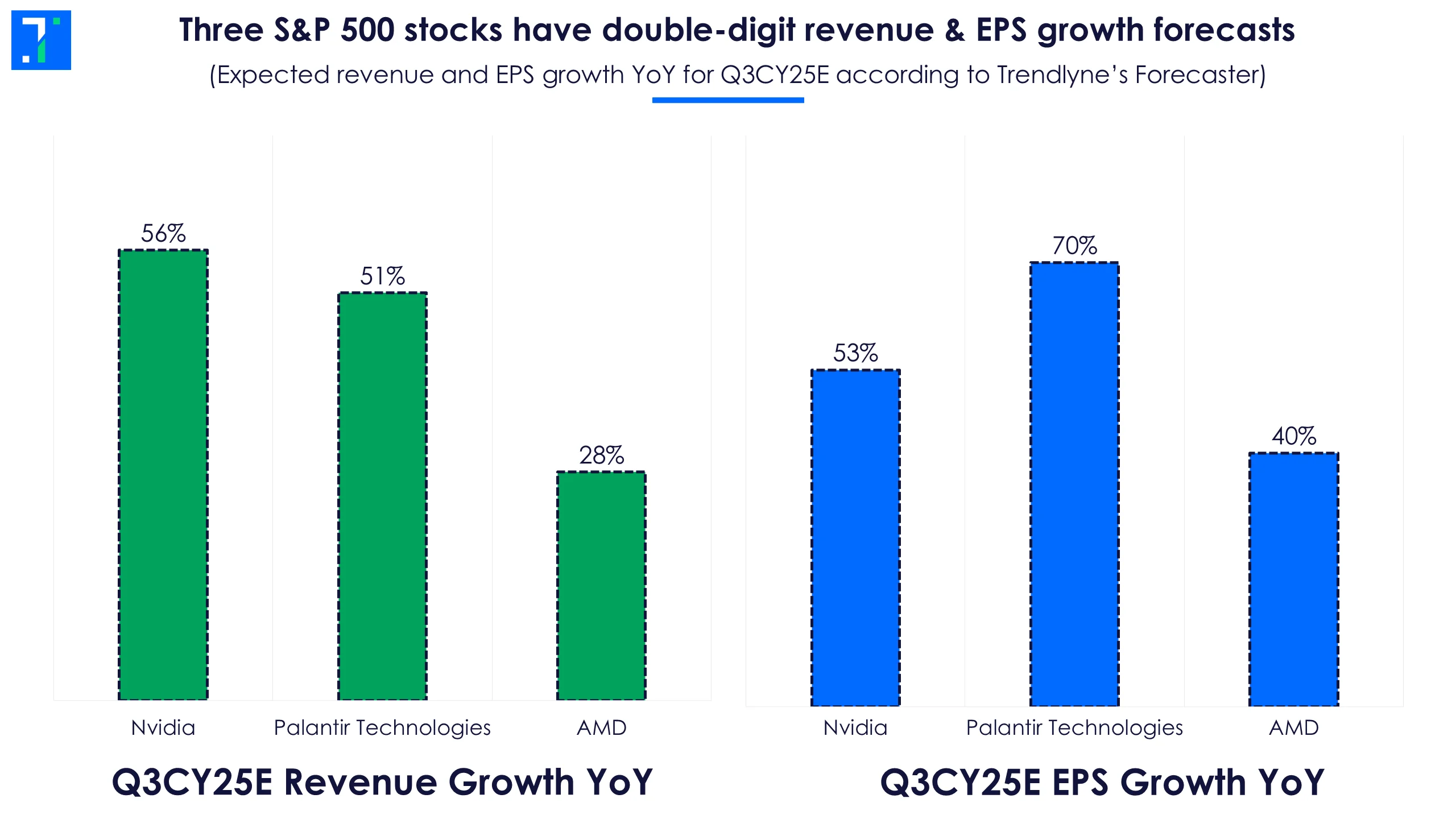

Right now, Nvidia is the market’s sun — when it shines, everything rises. Its immense influence explains why all eyes are on its upcoming results. Analysts forecast Q3 revenue growth of 56% and see EPS up 53% YoY, driven by still-unmatched leadership in GPUs and enterprise AI partnerships.

“Nvidia is well-positioned to extend its rally into 2026 and beyond,” notes UBS.

But there are also other S&P stocks seeing double-digit growth.

Three S&P 500 stocks have double-digit revenue & EPS growth forecasts

-

Advanced Micro Devices (AMD) is projecting strong performance for its Q3 2025 earnings, thanks to data center and processor demand. The company has guided for quarterly revenue in the range of $8.4-9 billion. Analysts echo this optimism, forecasting a 40% increase in EPS.

-

Analysts forecast 70% EPS and 50% revenue growth YoY to $1.1 billion for Palantir Technologies. This is being fueled by the overwhelming adoption of its AI Platform (AIP).

However, some analysts warn that Palantir's valuations are stretched. RBC calls Palantir “the most expensive name in our software coverage.” It says the current valuation “looks unsustainable” without a significant earnings beat and raised guidance.

Quiet Winners: Three midcaps set to outperform in the long run

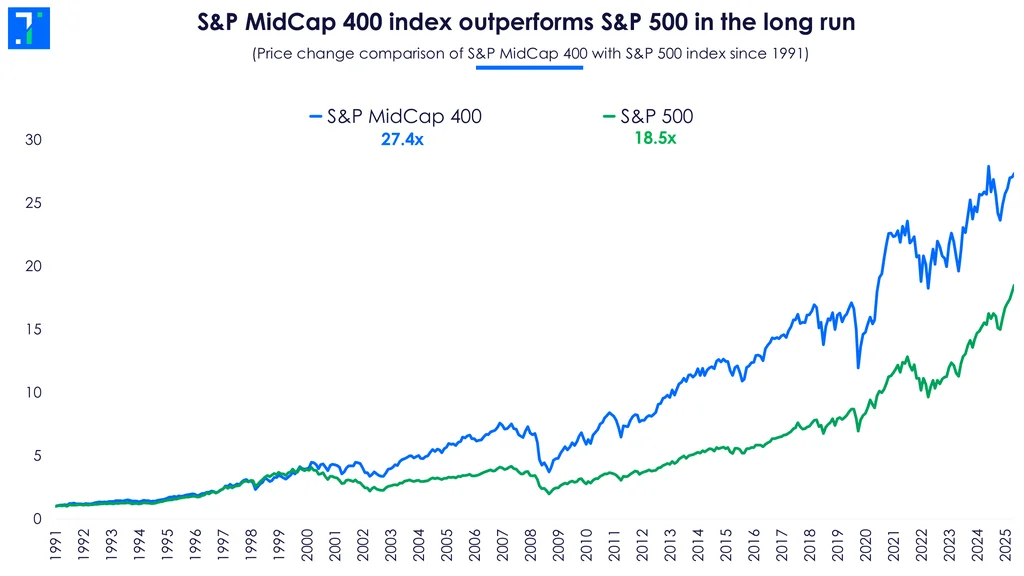

The AI wave isn’t just lifting the giants, it’s boosting midcap stocks too. Over the long term, midcaps have outperformed large caps by a wide margin, and this trend seems set to continue.

S&P MidCap 400 index outperforms S&P 500 in the long run

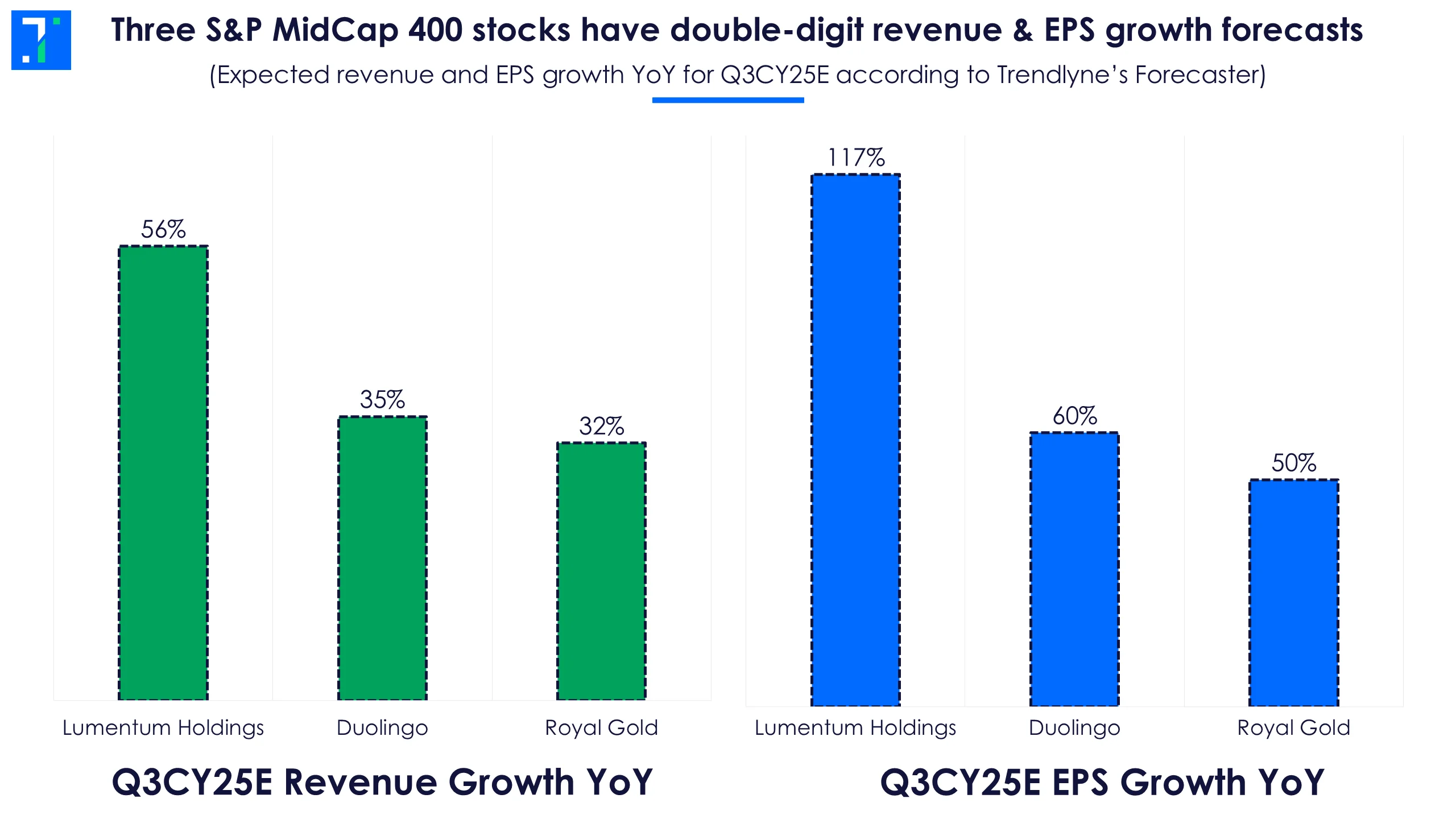

In the AI gold rush, it's midcap companies providing critical "picks and shovels" that are thriving, and Lumentum Holdings is a good example. This telecom equipment manufacturer stunned Wall Street by swinging to a profit in the last quarter, defying consensus estimates of a loss.

This turnaround was led by demand from its cloud and networking segment, which accounts for the majority of its sales.

Lumentum's new CEO, Michael Hurlston, said this was the direct result of the AI boom. Lumentum supplies the essential optical and photonic hardware, like advanced lasers, high-speed transceivers, and circuit switches, that enable the massive, energy-efficient data transmission required for intensive AI workloads. And thanks to the soaring demand from data centers, analysts expect the firm to report revenue growth of over 50% in Q1 and another profitable quarter.

Three S&P MidCap 400 stocks across industries have strong revenue & EPS forecasts

Duolingo, the go-to app for learning languages, continues to dominate with its playful, AI-powered learning model. The company raised its full-year guidance after an impressive first quarter.

“We exceeded our own high expectations for bookings and revenue this quarter, while expanding profitability,” said CEO Luis von Ahn. Bookings jumped 84% in Q2, with monthly active users up 24% to 128.3 million. For Q3, revenue is expected to rise 35% YoY with EPS growth of 60%. Forecaster suggests that analysts remain bullish on the stock, with an average price target of $442, an upside of over 40%.

The third company to watch: rising on the back of surging gold prices, Royal Gold doesn’t mine gold itself; rather, it finances miners in exchange for rights to buy a share of their output at discounted prices, a model known as streaming. This gives it steady profits without the risks of running a mine.

With gold prices having topped $4,300, Royal Gold has enjoyed strong margins. Prices have cooled slightly as US-China tensions ease, but they’re still up more than 50% this year.

The company reports Q3 results on November 5. Analysts expect revenue to be up 32% and EPS up 50% from a year ago.

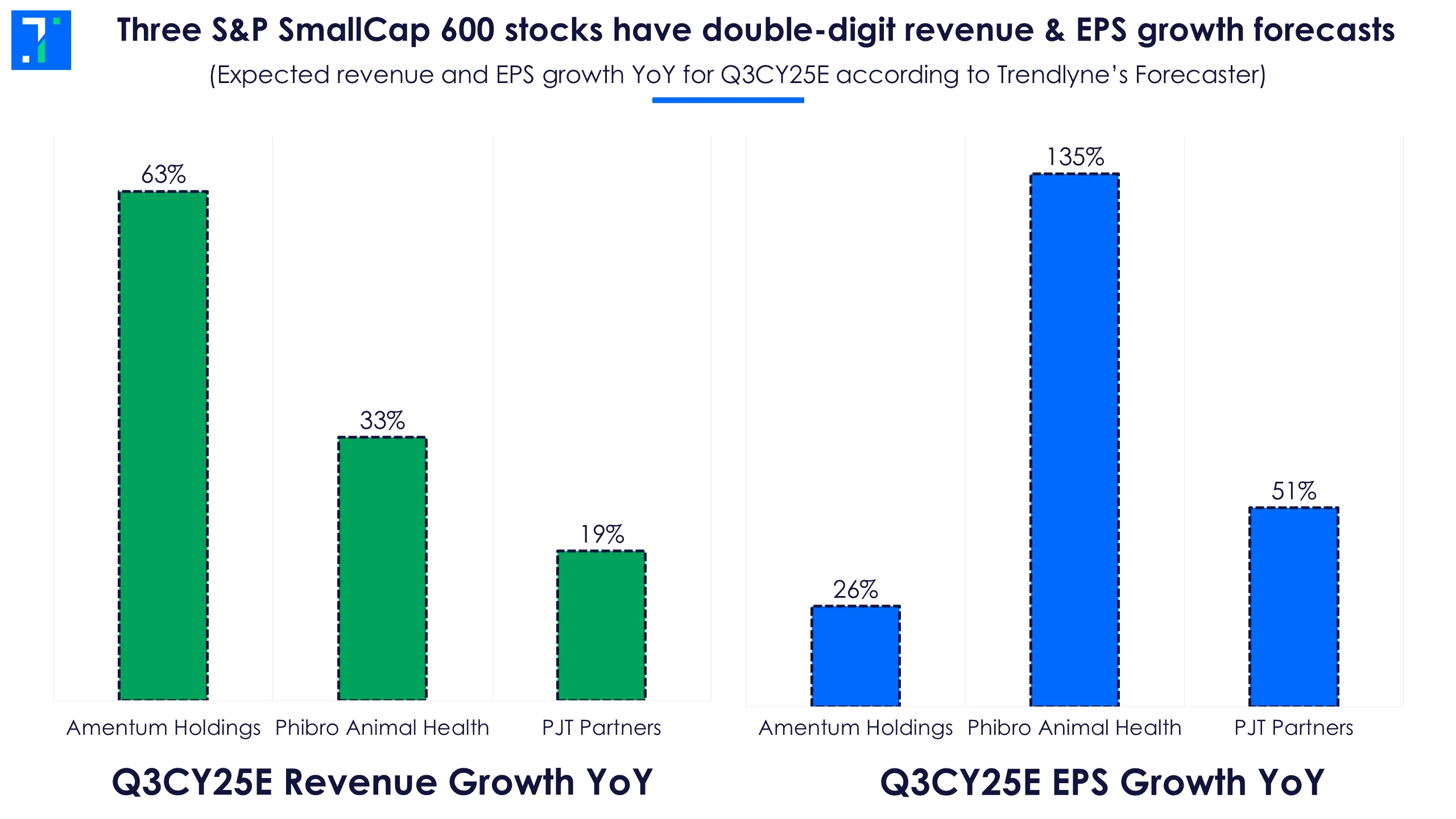

Smallcaps: hidden value in plain sight?

Morningstar’s David Sekera sees small-caps "trading at a 16% discount to fair value, while large caps are at a premium.” Some stocks to watch?

-

Amentum, a global engineering leader, continues to grow on a $45B project backlog, and is expanding its nuclear and space projects as energy demand surges. With $5 trillion expected to flow into data centers, nuclear energy may be the only scalable, reliable power source to meet its needs.

-

Phibro, which focuses on animal nutrition and health, expects steady growth despite modest tariff pressures.

-

PJT Partners, a boutique investment bank, is riding a strong M&A rebound, with 29% EPS growth and the company seeing “the best M&A year in a decade.” The firm has been on an “aggressive” hiring spree to prepare.

Three S&P SmallCap 600 stocks across industries have strong revenue & EPS forecasts

The market is walking a tightrope. So far, AI spending and earnings strength are offsetting inflation and macro stress. If the rally survives the 'bubble' narrative, the next phase may be broader than anyone expected.